Sinking into the Casper Mattress Story

The cofounders had been meeting at a co-working space for a while. They were thinking through business ideas, but they always kept coming back to mattresses. Philip Krim, Casper’s cofounder and CEO, had started an ecommerce business while he was at UT. The mattress category was surprisingly successful. He always had his eye on it, and it looked like he was going to be able to convince his four cofounders to consider it.

Buying a mattress is a terrible experience. The brands are staid and unloved. The process seems designed to lure you into a showroom with a commissioned salesperson who is trained to extract as much money from you as possible. You walk out with a five-thousand-dollar mattress that you qualified by laying on it for five minutes after it’s been abused in a showroom by countless other customers.

Tempurpedic was the last innovation in the mattress industry, and it’s decades old. The first cracks in the market predicated on choosing spring-counts, foam content, and myriad other qualifiers for the variety of mattresses pitched by mattress showrooms appeared when hotels started selling their own branded mattresses. Unlike the showroom experience, hotels stock one mattress. It’s designed to be comfortable for everyone. Why couldn’t a mattress company do that? There was a void in the landscape.

In March 2014, they raised a small seed round of $1.6 m to begin tackling the idea in earnest. They spent the first nine months doing research and development. The product had to provide a universal improvement in sleep quality. One of Philip’s cofounders, Jeff Chapin, was an industrial designer at IDEO. He brought his deep experience with the materials, the problems, and the packaging to sleep. It needed to be the best, to fold in a box, and provide a high degree of value per consumer dollar.

For a business that was virtual at its core, they thought a lot about the customer experience. The customer experience – the customer journey – would be central to Casper. They saw the whole customer experience as a brand-building opportunity. They thought about unboxing. What does the mattress do as it expands? How does the customer experience it? They wanted to personalize the brand. They wanted to make buying a mattress enjoyable and rewarding – through the process and the product. The answer started with the patented combination of latex and memory foam with iconic a white top with a grey side-panel.

What Philip and the team didn’t expect was, though designing a mattress for a good night’s sleep was hard, getting a manufacturer online was going to be at least as difficult.

The mattress industry hides fat margins and a cycle of private equity buyouts, recaps, and bankruptcies. Simmons Serta and Tempur Sealy control most of the manufacturing and have been largely protected from low-cost imports by virtue of just how colossally inconvenient and expensive it is to freight them in from Asia.

The remaining manufacturers often operated under the scrutiny or discretion of the controlling duopoly. For Casper, it meant that they had to fight to even get a manufacturer. Most manufacturers wouldn’t talk to them. The initial volumes were either deemed too small or they were too colored by the perspectives of the incumbents.

Casper, from the start would change how manufacturers work with a mattress brand. Typically, a Simmons Serta, for example, will request a large production run, warehouse their inventory, in a region, and merchandise it at local showrooms. Casper, on the other hand, maintains a just in time inventory process that essentially asks manufacturers to make mattresses to order for customers. Rather than warehousing the finished product, they ship it directly to customers via UPS from the factory. It’s far more capital efficient and keeps them customer focused.

Casper started selling on April 22nd, 2014. With three new hires, they had grown to eight people, all sitting in a small office on Bond Street in Noho. Casper did $1m of sales in the first twenty-eight days. They weren’t just selling to friends and family. Something else had happened. Something big.

They needed to get ahead of the supply chain. Early on, they were always running out of product and posting delays. The supply chain in the first 12-18 months was a big challenge. They have IT infrastructure supporting just-in-time ordering and deliveries now, but it wasn’t always so reliable or easy. Philip and the team, however, turned it into an opportunity. They over-communicated with customers, learned about who they were, and established the foundation for long-term relationships. While the traditional mattress buying experience was derelict and disappointing, Casper would further separate themselves through service. They introduced the 100-day trial.

Customers began posting the unboxing videos Philip and the team had speculated about. The videos became part of the virality of the Casper sale that the team didn’t expect, and they were rapidly becoming the fastest growing consumer business ever.

The flipside of growth, however, was scale. They needed to grow headcount. They needed more money. Casper raised a Series A in August 2014 and brought in new investors, such as NEA and Silas Capital. They used part of the capital to expand into Canada. In June 2015, they raised from IVP and Pritzker. They closed 2015 –just over eighteen months into production—with $100m in sales. Nonetheless, Philip found time to get married in October, along the way.

By the end of 2015, Casper had dramatically grown its customer base. Unlike a traditional mattress company or retailer, Casper knows their customers. Not only did they sell and ship them a mattress, with no retailer intermediary, they focused on establishing a long-term relationship. It starts with saying, thank you. For their first customers, Philip and his team went to the Strand and bought crates of leather-bound books. They brought them back to their office, wrote personal messages of thanks on the cover pages, and shipped them along with the mattress to each customer. A mattress and a Tale of Two Cities, perhaps.

If imitation is the greatest form of flattery, then Casper has many admirers. Not only has their innovation and success inspired copy-cats like Leesa, Karma, Lull, Tuft & Needle, Purple and many others, but the incumbent mattress brands have taken Casper’s lesson to heart. Tempur Sealy launched Cocoon, as a direct to consumer brand at the price scale of Casper. The incumbents, such as Tempur Sealy, however, must face a problem unique to their situation: channel conflict. Some 90% of their revenue derives from retail sales at higher price-points, so Cocoon can only succeed at the cost of their traditional retail channel as they turn individual $2.5k sales into $800 sales. It effectively begins to cannibalize their market.

The upstarts, on the other hand, have proven to be plucky competitors, nipping at their heels. While Consumer Reports rated the Casper mattress the number one foam mattress on the market for 2018, the field is now rife with players. The 2018 Wirecutter reviews work to provide a more balanced field of options and provide plenty of space for other manufacturers through a variety of categories: side-sleepers, rotators, back-sleepers, etc. Indeed, everyone has an opportunity to shine in their review.

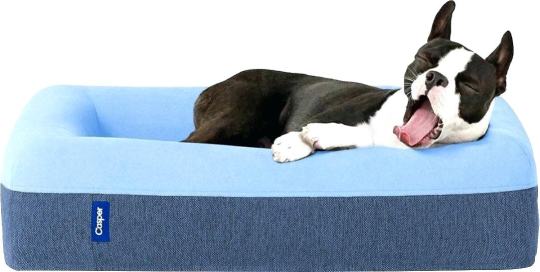

But Casper has continued to set itself apart. Casper has responded through new products and their interplay with subtle and effective marketing strategies. They launched the dog mattress in August of 2016, which not only drove sales, it also drove an enormous rise in consumer generated content about Casper, mattresses, and their dogs. What started as a product launch became a free marketing campaign based on fan-media on social media. It was carefully tuned to drive fan-contributions and promotion to further entrench and spread the Casper brand.

Investments in content marketing to spur their fan community and consumer interest have led to Van Winkles and its latest evolution: Woolly, a wellness magazine, which focuses on wellness and comfort. They even launched a 1-800 number campaign that encouraged people to call in for ways in which they could fall asleep – by listening to forest sounds, waves, or a monotone voice, droning on. Now, Casper has opened more than 20 retail stores across North America that reimagine the sleep shopping experience. All of this has kept the community talking about Casper and what it will do next.

These investments and market adoption have led to strong indirect channels through merchandising relationships. In May of 2017, they announced a retail partnership relationship with Target, through which they would be the key mattress provider for all Target stores. Meanwhile, they partnered with American Airlines in which they became the branded lay-flat-bed provider, as of mid-2017.

The team and team dynamic that Philip has developed, has been key. Seasoned, strong candidates from big, successful brands are drawn to Casper. The team includes executives fro Kate Spade, Apple, Google, Uber. He’s also introduced a sleep lab in San Francisco that counts more than fifty researchers and engineers focused on advances in sleep science and technology in the interest of product innovations. Of the more than 350 that work at Casper, nearly none have turned over. He attributes much of this to his and his team’s deep commitment to the underlying mission – to deliver everyone a good night’s sleep. It’s simple and seems obvious, but it’s exactly the kind of rallying cry that binds the team together, focuses everyone on the market, and separates Casper from its competitors. Casper is a compelling place to make a career bet – a place that competes with the strongest brands in the world.

The mission-driven approach to Casper informs every aspect of the business. Philip shifted the business to a B-Corp, so he could score themselves and their suppliers on their social impact. He continues to be a key contributor, supporter and partner to Charity Water, and he takes the time to make additional, spontaneous contributions, such as donating mattresses to firehouses in NYC.

Casper entered 2016 with more than 100 employees, a $200m revenue goal, and the prospect of market launches in Europe alongside their third anniversary. By the end of 2016 , they had met their goal, counted more than 200 people on the team, and were planning for even more growth through global expansion into new markets. And 2018 promises more of the same.

It’s been a remarkable rise for Casper through Philip’s leadership. He continues to attract the most prestigious job candidates. The core business continues to grow and has benefited from the expansion of product categories, distribution channels, and new markets. And he continues to press his team on the core mission and responsibility of the business - sleep, for all. Thanks to Casper, we’ve come more than a long way from uncomfortable showrooms with aggressive salespeople in bad suits.